This article is written in partnership with the Ministry of Communications and Information in support of Forward Singapore.

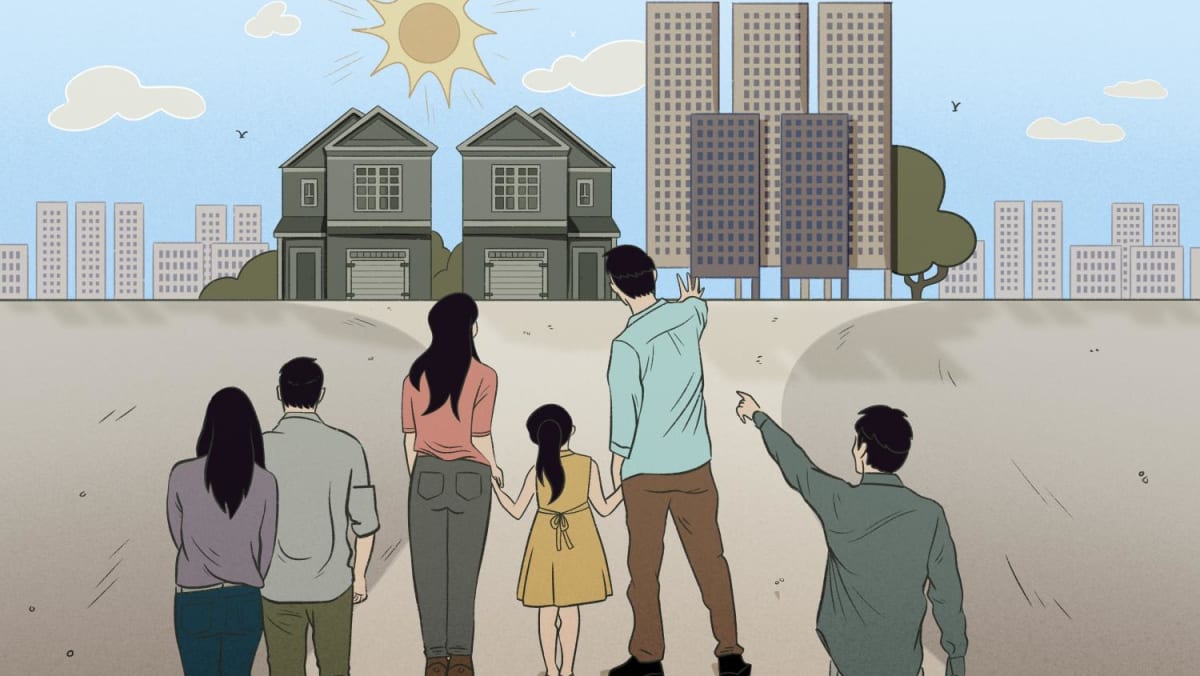

Over the past few decades, it is not only property prices that have risen in tandem with Singapore’s rapid economic growth — housing expectations and aspirations of the younger generations have gone up tooSome of these today include owning a private property in one’s lifetime, being able to afford a bigger flat in a good location and having more options for singles Meeting Singaporeans’ housing needs and aspirations is a perennial concern, with the topic being aired in Parliament from time to time. Outside of Parliament, it is also a common topic of discussion among Singaporeans What is less talked about, however, are the trade-offs involved when a land-scarce city-state measuring 719 sq km seeks to meet the housing needs and aspirations of over four million residentsTODAY examines some of these trade-offs

SINGAPORE — When Mr J Parasuraman and his wife moved out of his parents’ three-room flat and bought his first house in 1986 from the Housing and Development Board (HDB) at the age of 29, there was only one thing on their minds: To have more living space.

“Even though there were only the two of us at that time, we knew we would be having kids. So, we decided to go for the executive maisonette,” said the 67-year-old executive director and consultant of a financial advisory firm.

He forked out about S$111,000 — a sizeable sum back then — to get his dream home in Hougang. Today, his unit can fetch between S$830,000 and S$1.2 million on the resale market, based on the listings of similar maisonettes in Hougang.

Almost four decades on, it is not only property prices that have risen in tandem with Singapore’s rapid economic growth — housing expectations and aspirations of the younger generations have gone up too.

Take 25-year-old entrepreneur Lhu Wen Kai for example. He moved out of his parents’ flat in 2021 and had rented a one-room condominium because he wanted more personal space.

A few weeks ago, he returned to living with his parents, as the rent has gone up too much. Having had a taste of living in a private property, he said he is unlikely to buy a public flat in future if he were to get a place of his own.

He added that if the prices of private properties are out of reach, he would move to a neighbouring country to “fulfill my private housing dream”.

Mr Lhu is not alone in having the aspiration of owning a private property.

The latest edition of the TODAY Youth Survey found that eight in 10 youths said owning a private property is one of their life goals, and six in 10 expect to be better off than their parents in terms of housing.

The TODAY Youth Survey 2023, which was conducted in August, polled 1,000 respondents aged between 18 and 35.

This was the third edition of the annual survey and it looked at youths’ views on housing, the importance of a university degree, career development, the gap between blue collar and white collar wages, and civic participation. The findings were published last month.

To keep public housing affordable, the Government currently provides targeted subsidies for certain groups deemed to need them the most, such as first-time homeowners, property analysts noted.

Huttons Asia’s senior director for research Lee Sze Teck said handing out more subsidies is the “easiest” way to help home buyers but cautioned that this is “not sustainable”.

Agreeing, Mr Mak said: “The subsidy that is paid up in the BTO exercises today is actually from the taxpayers of yesteryears.”

Handing out more subsidies to flat buyers simply means growing a bigger bill that the latter would “end up also paying for” indirectly through taxes, he added.

Mr Christopher Gee, senior research fellow and deputy director at Institute of Policy Studies (IPS), said that it is worth considering whether it would really be better to expand subsidies to include multiple-time home buyers or upgraders who can “clearly afford” a higher value home, or if the aid should remain focused on helping people take that “first step on the upward social mobility ladder.”

This is given Singapore’s other public expenditure needs, such as caring for an ageing population, he said.

With demand partly contributing to rising prices, Mr Alan Cheong, executive director for research and consultancy at Savills Singapore, said one way to cool housing demand is by managing population growth, particularly by “turning off the immigration tap”.

Mr Song from CGS-CIMB noted that hypothetically, reducing Singapore’s population size could limit housing demand to a certain degree, but such a move taken to the extreme would only be detrimental in the long run, given Singapore’s ageing population.

“We have fewer youth and people are ageing fast. The population will die off. Then, what do you want to do with your property or your car, when there’s nobody who wants to buy?”

Singapore must also maintain a healthy population size in order to sustain economic growth and generate well-paying jobs, he added.

WHY CAN’T WE BUY LOW, SELL HIGH?

Ms Zakiah said that when her flat reached its minimum occupation period (MOP) about two years ago, she and her husband were contemplating selling their home as it was a “sellers’ market”.

While their home could have fetched a handsome sum on the resale market, she noted that the price of a new home would likely cancel out any gains, unless they choose to downgrade.

While market cooling measures can go some way in making houses affordable, Ms Zakiah said that there must be some balance so that sellers can make some money too. “If you sell at a loss, it would be more difficult to afford the next house,” she added.

Mr Gee of IPS said that subsidies for new flats have benefited first-time buyers by making such homes affordable. And when these owners sell their flats, they can enjoy capital gains and are able to “monetise” the subsidies.

“We are now seeing the consequences of that. It (capital gain) has been desirable. It has done some things in terms of savings accumulation, the build-up of home equity for Singaporeans,” he added.

Mr Mak of Mogul.sg noted that as of 2022, there were over 1.2 million owner-occupied HDB flats.

Pointing out that Singaporeans typically use CPF savings to pay for their flats, he noted that suppressing resale market prices would effectively “reduce your wealth, (affecting) the flat in which your CPF money is invested in”.

“You’re using your CPF money, your retirement fund is tied to your flat,” he said.

“Imagine the next generation of buyers, because they… want cheaper flats, you’ll make everybody else’s flat worth less? That’s quite disruptive,” he said.

Mr Song said that realistically, a homeowner cannot have it both ways. “Unless obviously, you’re looking at different (housing) areas, where you hope to benefit from the higher selling prices from that particular area, and benefit from an area where you may not have to pay as much (for a house),” he said.

WHY CAN’T EVERYONE HAVE HOMES IN GOOD LOCATIONS?

For Ms Tan the undergraduate and her boyfriend, location is a key consideration when picking a house, as they do not intend to buy a car.

“I just want to get a BTO flat within walking distance of an MRT station,” she said.

Ideally, they would also like to live near their respective parents — either at Bedok or Jurong East — and have tried applying for a flat in those areas, but to no avail.

Their sentiments echoed that of other young couples who had previously spoken to TODAY about not compromising on certain attributes when applying for a BTO flat, such as proximity to parents and connectivity to transport nodes.

At the National Day Rally (NDR) this year, Prime Minister Lee Hsien Loong announced that a new “Plus” model to classify public housing projects will be introduced from the second half of next year, and the current mature and non-mature estate classification will be phased out.

Under the new classification system, buyers of Plus and Prime flats — which are at more desirable locations — will get more subsidies from HDB but they will also face tighter restrictions, such as a 10-year minimum occupation period. The extra subsidies that applicants received must also be paid back to HDB upon resale, among other restrictions.

However, the experts pointed out that any loosening of criteria to buy a private property would lead to a growth in demand, hence driving up prices. And even if more land were to be set aside for private property developers, there is “no guarantee” that prices would fall.

IPS’ Mr Gee said developers in the private market are at liberty to set prices “however they wish”.

“If you (the Government) sell more land to private developers, are you then able to control the price of housing? They (developers) can charge whatever they want,” he added.

Mr Mak of Mogul.sg said that while there may be some degree of competition among different developers, it would not lead to lower prices as they would first and foremost want to protect their profit margins.

He added that developers would also need to bid for the land parcels which they intend to build the housing project on, which would then be taken into account when selling the properties.

The latest Home Attainability Index, which was published in May by the Urban Land Institute (ULI) Asia Pacific Centre for Housing, found that the median price of a private home in Singapore was the highest among 45 cities which the report looked at. The median price of private homes was 13.7 times that of median annual household income in Singapore, the report said.

Mr Song said that from a policy standpoint, the Government’s priority is to cater to first-time homeowners and ensure that they are able to afford public housing.

“(It is) not about making private housing more affordable because that’s not the policy objective of homeownership,” he reiterated.

WHY CAN’T WE HAVE MORE HOUSING OPTIONS FOR SINGLES?

Logistics professional Faizul Anuar, 39, moved out of his parents’ two-room flat eight years ago after his brother’s family moved there.

He had wanted to buy a flat but did not meet the minimum age requirement back then. Even when he reached 35 years old, he was faced with very limited choices as singles were only allowed to buy new flats in non-mature estates — a regulation that will be lifted from the second half of next year.

Hence, he had no choice but to rent a room in a condominium.

The TODAY Youth Survey found that 76 per cent of respondents believe the minimum age for singles to buy an HDB flat should be lowered from the current floor of 35. At the same time, 75 per cent feel that society should prioritise public housing for families.

Likewise, Mr Faizul said he wished that singles like himself can be allowed to buy smaller flats at a younger age.

“Some singles can actually afford a two- or three-room by the age 30. I don’t think people who want to have families would want to buy those types of flats,” Mr Faizul said, adding that singles can own a home without directly competing with couples or families.

Right now, he is looking to buy a four-room HDB flat, so that he could bring some of his family members to live with him.

“My nephew and niece (his brother’s children) for the last six or seven years have been living in the living room,” he said. “I’m buying this house as a single, but I have obligations to family members, who can also occupy this house.”

When HDB’s home ownership scheme was set up back in 1964 to support the marriage and parenthood aspirations of Singaporeans, those who were unmarried were not permitted to buy a public flat.

But over the decades, the rules for singles to buy an HDB flat have changed progressively. A turning point was reached in 1991 when the Government introduced the Single Singapore Citizen Scheme that allowed singles aged 35 and above to buy from a limited pool of smaller flats from the resale market.

In the last two decades, the Government has also upped housing grants and increased access to more flat types for singles. Another milestone was crossed after Mr Lee announced at this year’s NDR that singles will be able to apply for a new two-room Flexi BTO flat or buy a resale flat in any estate from the second half of 2024.

Dr Tan of PropertyGuru said the measures to be implemented next year to give singles more accessibility to public housing is “a step in the right direction”.

However, he also pointed out that two of the five national Shared Values adopted since 1991 are “family as the basic unit of society” and “community support and respect for the individual”. The shared values were adopted to help forge a common Singaporean identity across all ethnic groups.

Housing policies would have to be “in tandem” with such values, said Dr Tan.

Other property analysts said that lowering the age for singles to buy HDB flats would potentially lead to more demand in the market and push up prices.

Mr Lee of Huttons Asia said that in such a scenario, it is likely that BTO flats would see a higher demand than resale ones, given their greater affordability.

“This may lead to calls for more flats to be built for singles. A balance needs to be struck between building for families and singles,” he said.

The analysts pointed out that even though singles and families may not compete for the same type of flats, diverting some space meant for bigger flats to build smaller ones for singles instead could still reduce the supply of flats for families.

While the analysts welcome the Government’s move to increase housing accessibility, some stressed the importance of a gradual and calibrated approach.

Mr Mak from Mogul.sg said it is important to note however, that countries such as Australia — which Brisbane is a part of — have an advantage when it comes to supplying housing for its population.

“They can just keep letting the cities expand to build more housing and so on. We, unfortunately, face challenges in this sense,” he said, pointing to Singapore’s limited land supply compared to sprawling Australia.

At the end of the day, Mr Gee pointed to how much the housing system in Singapore has already achieved.

“It’s allowed multiple generations of Singaporeans to become property owners. There’s a genuine national benefit, societal good in having that ownership ethos for Singaporeans,” he said.

“It anchors people to the society, they have a tangible stake in this society in this country called Singapore. Because we are a nation of home owners, not just tenants.”